Rural Solar Off-Grid Electrification

Business Model Description

Develop and manage solar power solutions designed for domestic and agro-industrial purposes. For off-grid domestic areas, small-scale solar systems equipped with batteries are suitable. These systems are capable of powering individual homes and supporting community infrastructure via mini-grids, which can also provide street lighting. In the case of agro-industrial applications, the focus shifts to larger solar mini-grid systems designed to meet the higher energy needs typical of rural agricultural operations. The business model can also involve public sector involvement through Power Purchase Agreements (PPAs), foreseen in the national energy policy.

Expected Impact

Tackle energy poverty among those who do not have access and contribute to reduction of CO2 by replacing unsustainable sources of energy.

How is this information gathered?

Investment opportunities with potential to contribute to sustainable development are based on country-level SDG Investor Maps.

Disclaimer

UNDP, the Private Finance for the SDGs, and their affiliates (collectively “UNDP”) do not seek or solicit investment for programmes, projects, or opportunities described on this site (collectively “Programmes”) or any other Programmes, and nothing on this page should constitute a solicitation for investment. The actors listed on this site are not partners of UNDP, and their inclusion should not be construed as an endorsement or recommendation by UNDP for any relationship or investment.

The descriptions on this page are provided for informational purposes only. Only companies and enterprises that appear under the case study tab have been validated and vetted through UNDP programmes such as the Growth Stage Impact Ventures (GSIV), Business Call to Action (BCtA), or through other UN agencies. Even then, under no circumstances should their appearance on this website be construed as an endorsement for any relationship or investment. UNDP assumes no liability for investment losses directly or indirectly resulting from recommendations made, implied, or inferred by its research. Likewise, UNDP assumes no claim to investment gains directly or indirectly resulting from trading profits, investment management, or advisory fees obtained by following investment recommendations made, implied, or inferred by its research.

Investment involves risk, and all investments should be made with the supervision of a professional investment manager or advisor. The materials on the website are not an offer to sell or a solicitation of an offer to buy any investment, security, or commodity, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction.

Country & Regions

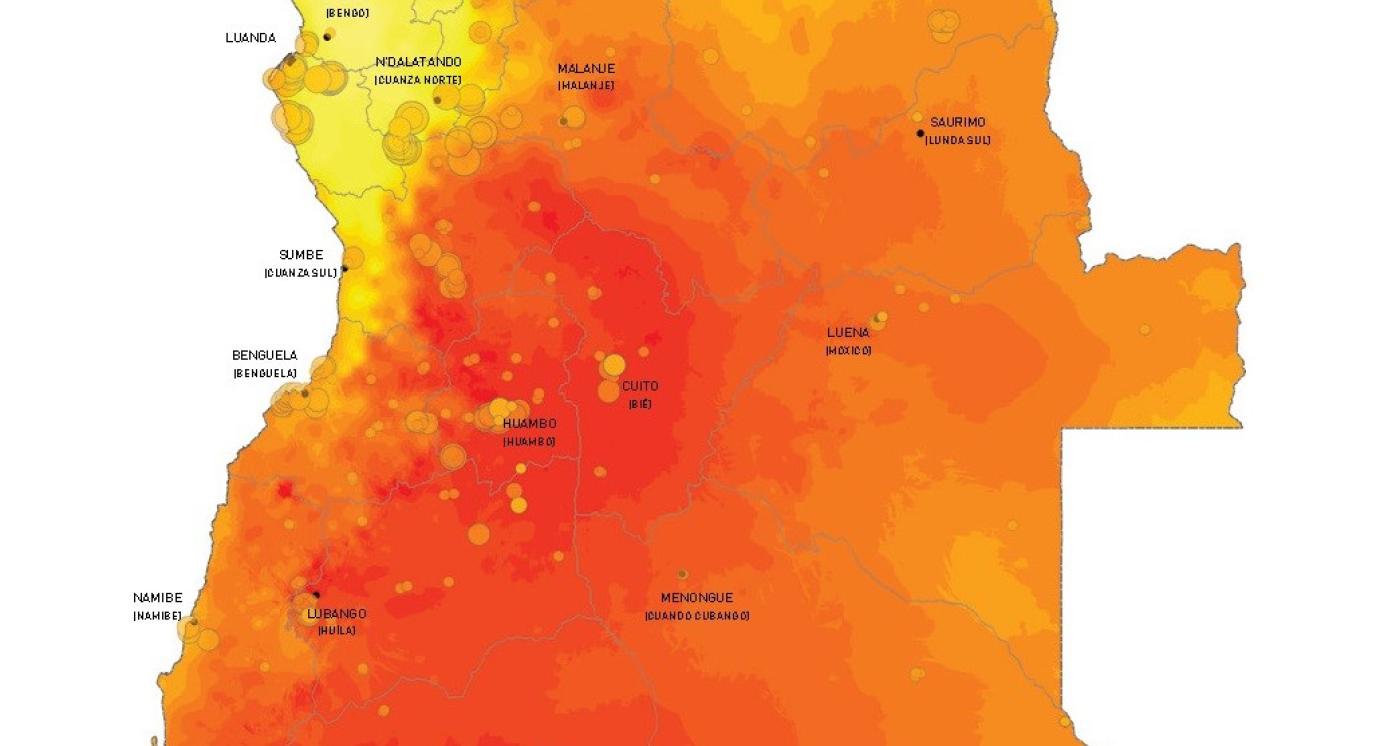

- Angola: Benguela

- Angola: Huambo

- Angola: Bié

- Angola: Huíla

- Angola: Namibe

Sector Classification

Renewable Resources and Alternative Energy

Development need

While progresses have been made in electrification (1), the insufficient energy distribution network in Angola means that around 80% of the population still relies on polluting charcoal, firewood and other biomass fuels (including indoor use, affecting health) (2).

Policy priority

Energy is one of the main priorities of the 2023-2027 National Development Plan (NDP), which aims to expand and modernize the infrastructure to optimize the production of renewable energy. The NDP also encourages the adoption of circular economy practices for waste management (3).

Gender inequalities and marginalization issues

Women are the primary energy users at the household level. Northern and interior populations are more marginalized regarding access to electricity (14). Populations not served by the national power grids, namely in the interior of the country, and women in general are more marginalized regarding access to electrical power (14).

Investment opportunity introduction

While large state investments in transmission lines are underway and can serve private investors, smaller solutions like solar mini-grids offer opportunities to provide access to electricity in rural areas not connected to the grid, including agro-industrial units (4).

Key bottlenecks introduction

Angola's renewable energy sector faces challenges like underutilized hydropower potential and the need for infrastructure and private investment to harness solar, wind, and green hydrogen energy (5).

Alternative Energy

Development need

A high proportion of population without access to clean energy calls for investments in this area. In Sub-Saharan Africa, only 20% of the needs are covered (6), and in Angola, only the coastal provinces are served hydropower gridlines.

Policy priority

Angola approved specific legislation for the energy sector and has a specific strategy for renewable energy, focused on hydro and solar. The implementation of a project to 'Promote Sustainable Access to Energy for Rural Communities in South-Eastern Angola' will start in 2024 (7).

Investment opportunity introduction

Solar energy in Angola is the most abundant renewable energy source in the country. The Atlas and National Strategy for New Renewable Energies show that Angola's energy potential is 80.6 GW, of which 55 GW comes from renewable energy. Solar solutions can take advantage of the progressive decrease in the cost of solar technologies observed over the years (8).

Key bottlenecks introduction

Ongoing challenges such as financing, technical expertise, and the need for comprehensive regulatory frameworks remain (9).

Solar Technology and Project Developers

Pipeline Opportunity

Rural Solar Off-Grid Electrification

Develop and manage solar power solutions designed for domestic and agro-industrial purposes. For off-grid domestic areas, small-scale solar systems equipped with batteries are suitable. These systems are capable of powering individual homes and supporting community infrastructure via mini-grids, which can also provide street lighting. In the case of agro-industrial applications, the focus shifts to larger solar mini-grid systems designed to meet the higher energy needs typical of rural agricultural operations. The business model can also involve public sector involvement through Power Purchase Agreements (PPAs), foreseen in the national energy policy.

Business Case

Market Size and Environment

USD 100 million - USD 1 billion

20% - 25%

In 2020, the Sustainable Energy Fund for Africa developed a Mini Grid Market Opportunity Assessment for Angola where it was estimated that the country has an annual mini grid market size of USD 252.5 million and an expected growth rate of 13.7% from 2018 to 2022, and 24.9% to 2025 (10).

Angola has significant solar energy potential, estimated at 55GW, yet only 42.8% of the population had electricity access in 2022. To address this gap, the country is constructing its first two solar power plants in Benguela province, with over 500,000 solar panels and a combined capacity of 285 MW. Another solar power plant project has been initiated in Namibe province, signalling Angola's commitment to expanding renewable energy infrastructure and increasing electricity access nationwide (23).

Indicative Return

20% - 25%

In the Angolan context, the IRR of a 15 MW solar PV project, originally 20.5% in Nigeria (22), could potentially increase due to several favourable conditions. Supportive regulatory measures like tax incentives and renewable energy subsidies, combined with higher electricity tariffs, could boost project revenues.

Investment Timeframe

Short Term (0–5 years)

The investment horizon of a 15 MW solar PV project, originally projected at about 3.5 years in Nigeria (22), could be shortened in Angola if the increased IRR translates into quicker recoveries of the invested capital. This acceleration could be facilitated by a combination of higher project revenues, lower operational risks due to stable economic conditions, and potentially lower initial project costs if favourable financing is secured.

Ticket Size

> USD 10 million

Market Risks & Scale Obstacles

Capital - Requires Subsidy

Impact Case

Sustainable Development Need

Angola has a pervasive lack of reliable energy in rural areas, which hampers economic development, particularly in agro-industries (12). In addition, a significant portion of the population lacks access to clean energy sources. For instance, only the coastal provinces serviced by the hydropower gridlines enjoy consistent energy access, leaving vast rural areas without reliable power (6).

A significant challenge lies in the widespread reliance on unsustainable energy sources in rural areas. Fuelwood remains a primary energy source for heating and cooking in these regions. Urban areas predominantly use charcoal, which is produced unsustainably, as the trees harvested for its production are often not replenished or managed under any sustainable exploitation or reforestation programs (24).

Gender & Marginalisation

Women are the primary energy users at the household level. Northern and interior populations are more marginalized regarding access to electricity (14).

Populations in the interior of the country, and women in general are more marginalized regarding access to electrical power (14). Fuelwood still constitutes one of the energy sources most commonly used in the rural areas of Angola for heating and cooking (24).

Expected Development Outcome

Rural solar off-grid electrification contributes to increased electrification rate by providing reliable, cost-effective solar energy solutions tailored to underserved populations in remote areas.

Rural solar off-grid electrification contributes to enhancing the renewable energy mix by introducing solar energy as a significant source of power in areas that were previously reliant on non-renewable sources like fossil fuels or traditional biomass.

Gender & Marginalisation

Rural solar off-grid electrification contributes to reducing reliance on unsustainable sources of energy like fuelwood among women and rural communities by providing them with a clean and reliable alternative for their energy needs.

Primary SDGs addressed

1.1.1 Proportion of the population living below the international poverty line by sex, age, employment status and geographic location (urban/rural)

According to the Angola Poverty Assessment by the World Bank, the incidence of poverty in Angola as of 2019 was 32.3% at the national level (19).

25% by 2025 (19).

7.1.2 Proportion of population with primary reliance on clean fuels and technology

The proportion of population with primary reliance on clean fuels and technology increased from 40.0% in 2000 to 50.0% in 2021 (20).

N/A

9.4.1 CO2 emission per unit of value added

In 2020, carbon dioxide emissions per unit of GDP were approximately 0.1 kg (20).

N/A

13.2.2 Total greenhouse gas emissions per year

The total greenhouse gas emissions (kt of CO2 equivalent) of Angola by 2020 was 70,78 (21).

N/A

Secondary SDGs addressed

Directly impacted stakeholders

People

Gender inequality and/or marginalization

Planet

Corporates

Indirectly impacted stakeholders

People

Gender inequality and/or marginalization

Corporates

Public sector

Outcome Risks

Waste management: The disposal of solar panels and batteries at the end of their life cycle can create environmental hazards if not properly managed, considering that these systems contain toxic materials that can contaminate landfills and potentially the local environment (15).

Land use: Solar farms require large areas of land, which can lead to habitat destruction, loss of agricultural land, or the displacement of communities (16).

Impact Risks

Continued lack of access to electricity due to infrastructure challenges, geographical barriers and limited financial resources would perpetuate energy poverty, limiting opportunities for education, health, and economic growth.

Without offering flexible payment options or subsidies, low-income households may struggle to access solar power solutions due to high upfront costs or ongoing expenses.

Without effective facilitation of community ownership and financing models, the cost burden may not be adequately spread, making solar power solutions less affordable for individual households and potentially limiting access to reliable electricity for rural communities.

Impact Classification

What

Increase access to electricity in rural areas, aiming to improve quality of life, health, education, and economic opportunities for communities, while promoting a balanced energy mix.

Who

Rural households, women, marginalized groups, private sector involved in agro-industrial models, and public institutions, focusing on rural communities.

Risk

Persistent infrastructure challenges, geographical barriers, limited financial resources, lack of flexible payment options, and ineffective community financing models could perpetuate energy poverty, restricting access to education and other key needs.

Contribution

The introduction of small-scale solar systems for domestic use and larger solar mini-grids for agro-industrial applications increases the share of renewable energy in Angola’s energy mix and supports the country's energy policy goals.

How Much

The solar power solutions are expected to add between 3-5% to Angola's renewable energy share in the midterm, aiming for an increase to 10% in the long term through expanded deployment and public sector involvement via Power Purchase Agreements (5).

Impact Thesis

Tackle energy poverty among those who do not have access and contribute to reduction of CO2 by replacing unsustainable sources of energy.

Enabling Environment

Policy Environment

Energy is one of the main priorities of the 2023-2027 National Development Plan (NDP), which aims to expand and modernize the infrastructure to optimize the production of renewable energy, including solar and off-grid solutions, especially towards rural electrification (17).

The Action Plan of the Ministry of Energy and Water (MINEA) includes the expansion of access to electricity through investment in renewables in partnership with the private sector, namely through the sale of 100,000 individual solar systems within the rural and municipal sub-programme and the creation of at least 200 new businesses to produce, maintain, distribute or sell renewable energy solutions for the rural areas (17).

Financial Environment

Financial Incentives: Small-scale initiatives to finance solar energy kits have been initiated, such as the Sun Africa projects (23) and can be expanded to connect rural communities.

Financial Incentives: The government will launch a tender for the granting of an authorization to build PV plants connected to the grid in rural areas, under an independent producer regime (8). The Development Bank of Angola (BDA) has been recapitalized to increase the capacity to provide concessional loans.

Regulatory Environment

Decree No. 78/23: Guidelines for the Preparation of the National Electrification Plan were released, whose ultimate objective is universal access to electricity by 2030 (17).

The country’s electricity sector is governed by the Electricity Law No. 27/15, which has been established by a Presidential Decree (No. 59/16) (18).

To attract and guarantee private investment, the ongoing revision and creation of sector regulations and the adoption of related legislation are being supported by the development of a Model Power Purchase Agreement for Renewable Energy, which aligns with international best practices and adapts them to Angolan legislation (10). The development of the PPA involves thorough consultations with stakeholders, including private investors, legal experts, and energy sector authorities, to ensure it addresses all relevant risks and provides a balanced, transparent framework. Once the PPA is in place, private sector entities can develop renewable energy projects, enter into PPAs with authorized power purchasers, and generate revenue by selling electricity.

Marketplace Participants

Private Sector

Greentech – Angola Environment Technology, Sun Africa, Total Eren, Solenova.

Government

Ministry of Energy and Water, Instituto Regulador dos Serviços de Electricidade e de Água - IRSEA (energy and water regulator), Empresa Nacional de Distribuição de Electricidade - ENDE (national energy distribution company), Rede Nacional de Transporte de Electricidade - RNT (National Electricity Transmission Network).

Multilaterals

United Nations Development Programme (UNDP), World Bank, African Development Bank (AfDB), (Africa Mini-Grid Acceleration Programme), International Renewable Energy Agency (IRENA).

Non-Profit

Lusophone Renewable Energy Association (ALER), Angolan Association of Renewable Energy (Asaer).

Public-Private Partnership

Solenova, a joint venture equally owned by Eni and Sonangol for the development of renewable energy project of 50MW in Caraculo (Namibe).

Target Locations

Angola: Benguela

Angola: Huambo

Angola: Bié

Angola: Huíla

Angola: Namibe

References

- (1) MINEA (2023). Plano de Acção do Sector de Energia e Águas 2023 2027. Luanda: MINEA). Source: https://www.minea.gov.ao/index.php/2017-11-19-18-06-34.

- (2) Africa Energy Portal (2022). Angola to buy 5000MW from Congo’s Grand Inga hydropower plant. Source: https://africa-energy-portal.org/news/angola-buy-5000mw-congos-grand-inga-hydropower-plant.

- (3) Governo de Angola (2023). Plano de Desenvolvimento Nacional 2023-2027. Source: https://www.mep.gov.ao/assets/indicadores/angola2050/20231030(3)_layout_Final_Angola_PDN%202023-2027-1.pdf.

- (4) ALER – Lusophone Renewable Energy Association (2022). Renewable Energy in Angola: National Status Report. Source: https://www.aler-renovaveis.org/en/activities/publications/national-reports/renewables-in-angola-national-status-report-2022/.

- (5) Energy Capital & Power (2022). Identifying Opportunities in Angola’s Renewable Energy Sector. Source: https://energycapitalpower.com/angola-opportunities-renewable-energy/.

- (6) Green Min-Grid Help Desk (n.d.). Introduction to mini grids. Source: https://greenminigrid.afdb.org/how-it-works/help-desk-developers-and-operators/introduction-mini-grids.

- (7) Kemp, Y. (2023). Angola to build PV electricity infrastructure across rural areas. Source: https://www.esi-africa.com/renewable-energy/angola-to-build-pv-electricity-infrastructure-across-rural-areas/.

- (8) MINEA (2015). Atlas and National Strategy for New Renewable Energies. Luanda: MINEA. Source: https://gestoenergy.com/wp-content/uploads/2018/04/ATLAS-AND-NATIONAL-STRATEGY-FOR-THE-NEW-RENEWABLES.pdf.

- (9) Energy Capital & Power (2022). Harnessing Angola’s Solar Power Potential. Source: https://energycapitalpower.com/harnessing-angolas-solar-power-potential/.

- (10) Sustainable Energy Fund for Africa, SEFA (2020). Mini-Grid Market Opportunity Assessment: Angola. Source: https://greenminigrid.afdb.org/sites/default/files/angola_gmg_mdp_report_051020-compressed.pdf

- (11) Green Min-Grid Help Desk (n.d.). Financial support schemes. Source: https://greenminigrid.afdb.org/how-it-works/helpdesk-policymakers-and-regulators/financial-support-schemes.

- (12) Energy Capital & Power (2022). Five Solar Projects to Watch in Angola. Source: https://energycapitalpower.com/top-five-solar-energy-projects-in-angola/.

- (13) AfDB (2023). In Angola, the African Development Bank supports the Renewable Energy Sector. Source: https://www.afdb.org/en/news-and-events/angola-african-development-bank-supports-renewable-energy-sector-59123.

- (14) Clark, L. (2021). Powering Households and Empowering Women: The Gendered Effects of Electrification in sub-Saharan Africa. Source: https://jpia.princeton.edu/news/powering-households-and-empowering-women-gendered-effects-electrification-sub-saharan-africa.

- (15) United States Environmental Protection Agency (n.d.). End-of-Life Solar Panels: Regulations and Management. Source: https://www.epa.gov/hw/end-life-solar-panels-regulations-and-management.

- (16) BOBBY MAGILL & CLIMATE CENTRAL (2015). Solar Power Expansion Could Pose Ecological Risks. Source: https://www.scientificamerican.com/article/solar-power-expansion-could-pose-ecological-risks/.

- (17) ALER – Lusophone Renewable Energy Association (2023). 'It is clear that the Angolan Executive will have to make a concerted effort (...) to involve private developers/investors'. Source: https://www.aler-renovaveis.org/en/communication/news/it-is-clear-that-the-angolan-executive-will-have-to-make-a-concerted-effort-to-establish-specific-and-clear-regulatory-policies-and-guidelines-to-involve-private-developersinvestors/.

- (18) AEP (2022). Angola - Regulatory Framework. Source: https://africa-energy-portal.org/eri/country/angola.

- (19) World Bank (2020). Angola Poverty Assessment. © World Bank, Washington, DC. http://hdl.handle.net/10986/34057.

- (20) UN STATS (n.d.). Country Profile: Angola. Source: https://unstats.un.org/sdgs/dataportal/countryprofiles/AGO#goal-7.

- (21) World Bank Data (n.d). Total greenhouse gas emissions (kt of CO2 equivalent) - Angola. Source: https://data.worldbank.org/indicator/EN.ATM.GHGT.KT.CE?locations=AO.

- (22) PFAN (n.d.). West Africa Forum for Climate & Clean Energy Financing Project Snapshots. Source: https://www.afdb.org/fileadmin/uploads/afdb/Documents/Generic-Documents/WAFCCEF-3_Project_Snapshots.pdf

- (23) CMS Law (2024). Renewable energy in Angola. Source: https://cms.law/en/int/expert-guides/cms-expert-guide-to-renewable-energy/angola#:~:text=Solar%20energy%3A%20solar%20radiation%20is,2%2C100kWh%20%2F%20m2%20%2F%20year

- (24) Mordor Intelligence (2023). Agriculture in Angola Market Size Source: https://www.mordorintelligence.com/industry-reports/agriculture-in-angola/market-size.Source: https://www.mordorintelligence.com/industry-reports/agriculture-in-angola/market-size

- (25) Global Data (2023). Angola Construction Market Size. Source: https://www.globaldata.com/store/report/angola-construction-market-analysis/

- (23) Sun Africa (2024). Harnessing the power of the sun to change our world. Source: https://sunafrica.com/projects/

- (24) Sustainable Energy For All (2015). Rapid Assessment Gap Analysis Angola. Source: https://www.seforall.org/sites/default/files/l/2015/05/Angola_RAGA.pdf